Let’s talk about the market. I have 9 graphs, yes NINE, to give you a quick yet comprehensive view into real estate now. Don’t worry — you don’t have to be an economist to interpret this data, and I’ve intentionally written this fairly untechnical.

Starting with prices, where are they now.

2025 was a pretty solid year for appreciation in Indiana. Solid but not out of control (what is going on central Wisconsin?!). Biggest housing gains in pricing are found in the Northeast & Midwest, while the Sunbelt states like Florida, Texas, and Arizona continue to see a pricing correction, which I do believe is coming to an end…

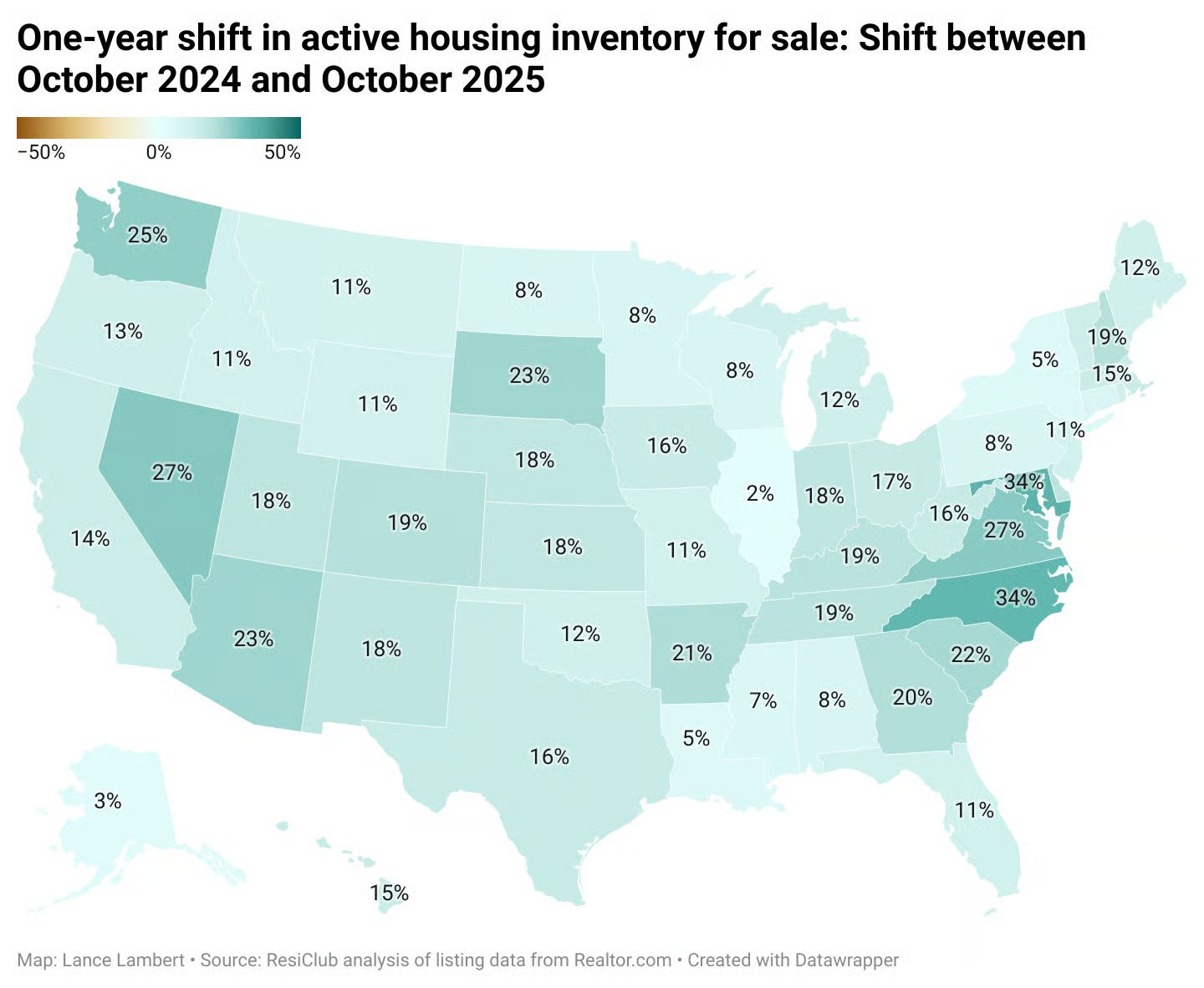

Another stat on the plus side: Indiana is up 18% from Oct ‘24 to Oct ‘25 in housing inventory supply. Early in the year, we saw fairly strong demand-side action in lower inventory environment, however that evolved into an inventory rise that started climbing after mid-June. Now, in Indiana about ¼ listings are dropping prices. (Source: Complete ad hoc estimate on my part witnessing the market, frankly).

Overall, Indiana has remained in the top category of home price appreciation in the 5-year picture.

Switching over to quick rate discussion… Mortgage rates closely track the 10-year treasury yield. Spreads between the 10-year T-bills and mortgage rates grew when rates hiked as mortgage-backed securities became less attractive to investors in a quantitative tightening environment. However, we are seeing normal spreads return, and thus moderate rates. Rates have been in the low 6’s for a healthy duration of time.

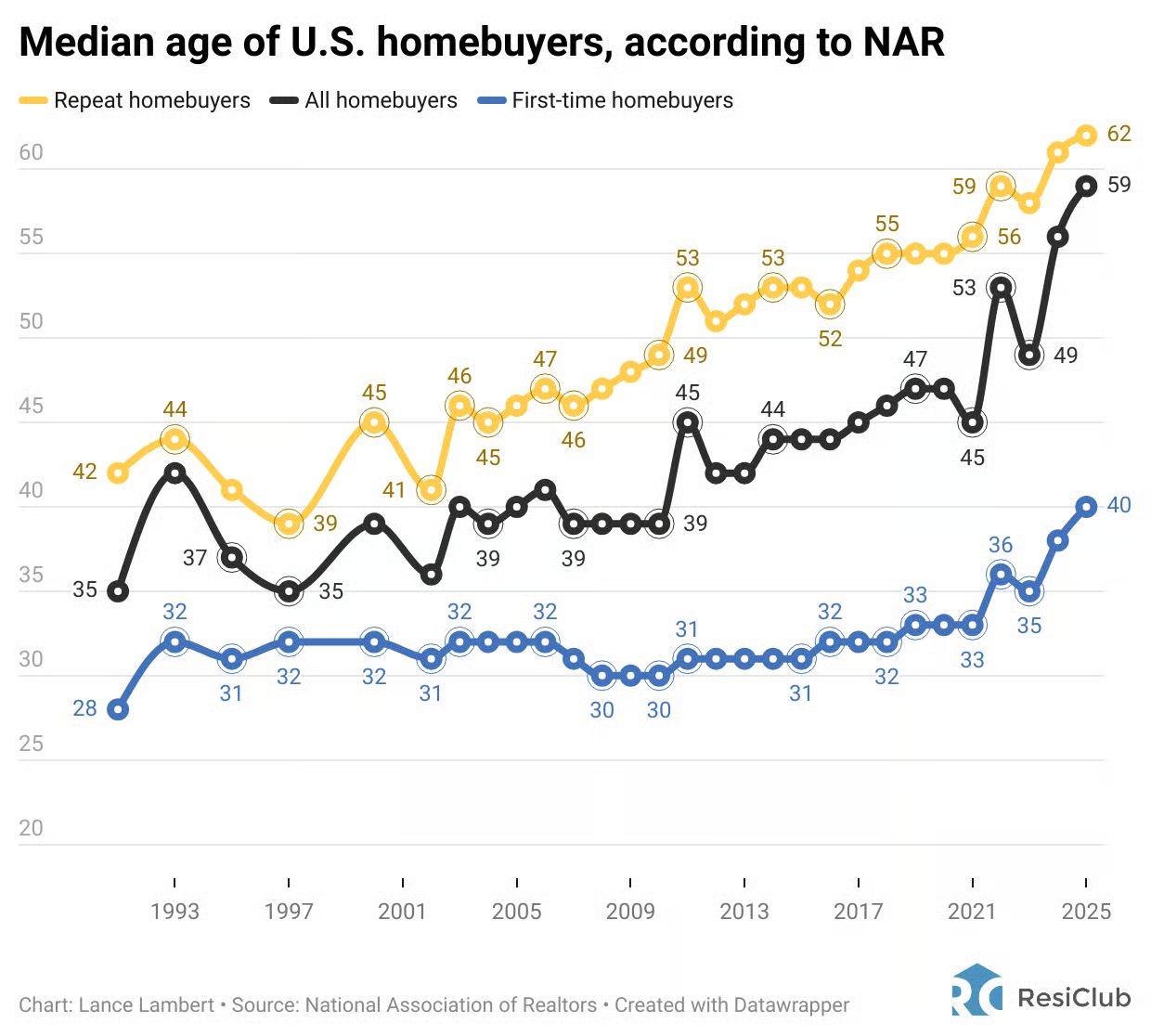

The NAR released new data that shows the median-aged homebuyer is 40 years old! This is a quantum leap from even just a few years ago (35). Personally, I think this is a travesty. Buying my first home at age 23 helped me quickly get to a net worth above $100,000 then later 1M through the value-add, appreciation potential of it, at a young age. Longer renters = longer wait to financial freedom.

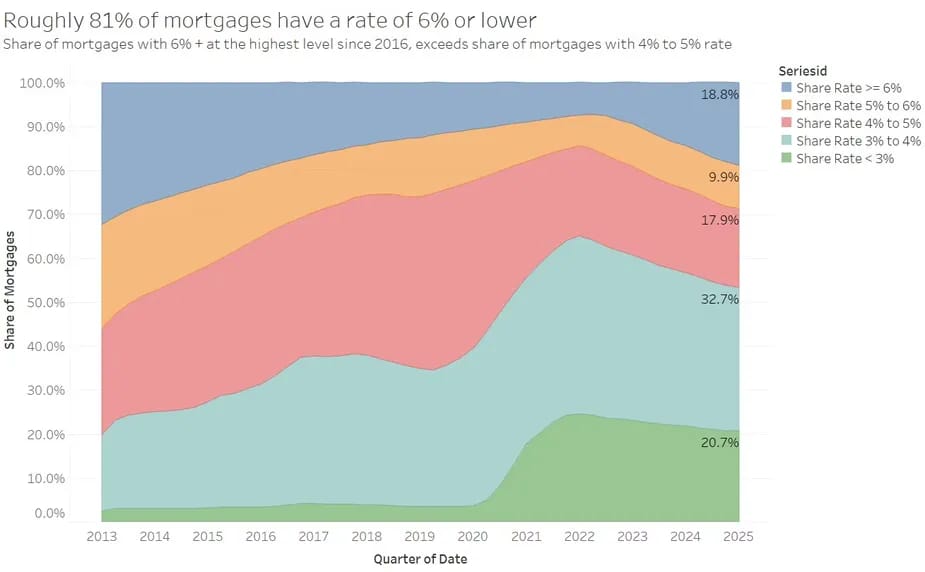

A large reason why prices remained strong during a higher interest rate environment was the “lock-in effect”. Everyone & their mother refinanced or bought into a 2-3% rate creating a massive resistance to buying up at a higher rate. As you can see, 77%+ of mortgage rates out there are still sub-6. The lock-in effect is eroding, however, it just takes time.

Which leads into the next graph…

Assuming you only want to spend 30% of your income yearly on housing payments, what is the necessary income required. Right now it’s a notch under $120,000 / year, however, the median home price in the US is above $400K. In Indiana, it is not. You can get a solid home in the sub-$200,000 category in Indianapolis. Don’t believe me, check out my deal breakdown below…

Credit: Logan Mohtashami (Instagram). Tying this all together — Is the market in the crapper or are we headed in the right direction? Right, this is the question?

November has now seen all time high pending sales in the last 4 years. Rates are holding steady under 6.6%, and the duration of lower rates is instilling confidence in home-buyers. Essentially, this is the strongest November the nation has seen in housing in a long while…

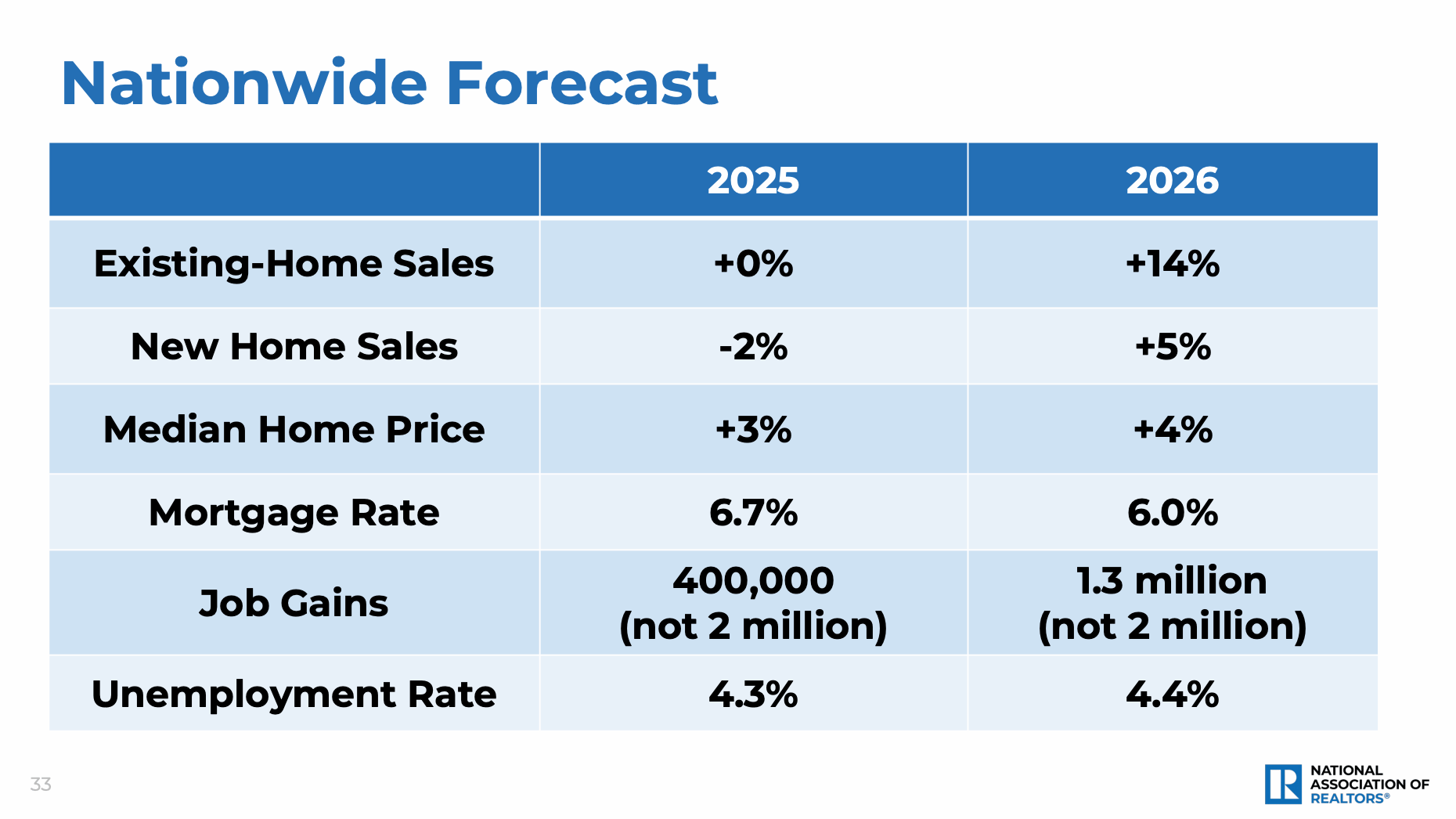

What about global predictions for 2025?

The NAR is predicting +14% in home sales in 2026. The key factor here is consistent rates in the low 6’s. Just enough to keep the wheels turning in the right direction. Personally, I think 2026 will be a tad less robust than this predicts, with 2027 being even more robust (in home sales). Regardless with rates & inventory in the right direction we have a lot to be thankful for heading into this holiday season!

Thanks for listening to my scatter-brained housing ted talk :)

Deal Breakdowns 🔥

No fancy deal breakdowns for you today. However, we have plenty of inventory for homeowners / investors alike.

Alright, just because you’re tempting me I’ll drop a few of my favorites including a Merdian-Park Duplex (empty side for house hacker) and an Irvington bungalow sub $200K…

For more awesome deal-breakdowns for investors, check out Roots agent Ken Fletcher’s RE: Indy newsletter here. Lots of gold in it!

On this episode of The Roots Podcast, Tyler Lingle and Max Moore sit down with Tadd Miller, co-founder and CEO of Milhaus, a $5B+ real estate firm reshaping urban neighborhoods. Tadd breaks down why running a 1-unit deal vs. a 200-unit deal isn’t as different as people think - and what that means if you actually want generational wealth, not just a handful of rentals.

He shares why he sold off his single-family portfolio, how to think about scale vs. “starter” deals, and when high-income professionals should stop buying more houses and start backing the right operators instead.

Consider Pressing Subscribe on the Podcast! It’s a simple way to support what we do and get plugged in. It takes 30 seconds…

Upcoming Events in Indy for the Investor-Minded!

December Real Estate Masterclass @ Guggman Haus Brewing — Topic: Finding Deals that Actually Make Sense led by Investor-Friendly Agents. Thursday, December 4th, Find details here!

January Coffee & Connect with Keynote Speaker Rex Fisher, co-owner of @properties IND, owner of RCA properties. Join us for coffee, bagels, and insightful conversation in the early morning! 7:30-9am January 15th, 2026. Find details here!