The market has been intriguing to observe.

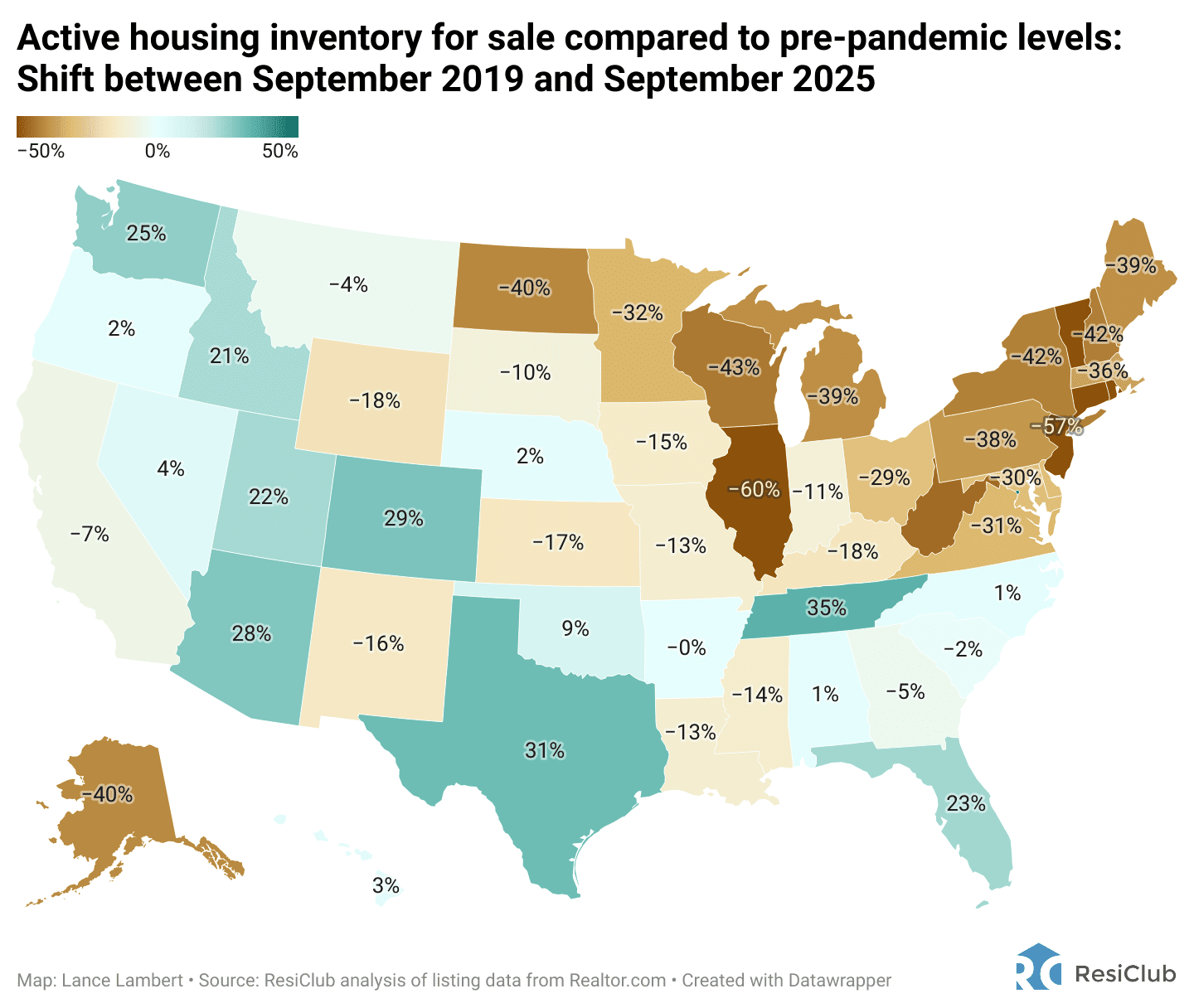

Indiana is still below pre-pandemic levels of inventory — which is buffering up stronger prices than some states namely TX & FL

The super TLDR snapshot (I am not attempting a long-form market overview here) is that there is a rather strong expectation the Fed pulls the rate down again in their October meeting, and potentially again in December, according to Investopedia.

Rates have been hovering around the lowest points they have in a long time. Right now the average 30 yr fixed rate is around 6.3%.

Inventory has bounced back strong in Central Indiana, easing pressure off buyers for the first time in around 5 years. According to MIBOR we have 2.5 month’s of inventory as of Sept. ‘25. This time of the year 2023 it was 1.8. 2022: 1.4.

This means it would take 2.5 months, in essence, for the market to satiate (pend / sell) the homes on the market. It’s probably the best metric to track the overall balance between Buyer vs. Seller leverage.

Interestingly enough the narrative is that it’s a Buyer’s market, but the data still indicates that Indiana is a Seller’s market. (A Buyer’s market would necessitate at least 3-4 months of inventory on the market, which we very well will likely see in Nov-Dec data…).

I don’t see much doom and gloom on the horizon. In fact, quite the opposite.

Inventory is at much more healthy levels, while rates are expected to decline making 2026 poised to be a better year for all parties — buyers, sellers, agents, PM’s, lenders included. Just my two pennies!

This Week’s Deals 🔥 — Starting with Grandma’s house from the 50’s ready for cosmetic flip!

Asking $125,000 - Off-Market

Renovation ~$20,000-25,000 (new flooring, cosmetic items)

ARV $175,000

3 bed, 1 bath, 918 sqft.

Newer mechanicals & solid bones; hardwoods under carpet!

1414 Ingomar St. Indianapolis, IN 46241 (near Speedway)

Asking $155,000

3 beds, 2 baths, 1084 sqft.

Rent rate $1400 / mo

Great for new investor or first time homeowner!

Asking $239,900

Turnkey Duplex

Currently rented for $1100 per side, tenants pay utilities

Leases up in Jan & May 2026

If you’re interested in any of the above deals (or to get your search started) email [email protected] 🤙 We also help sellers (duh).

New Podcast w/ an OG Indy Investor GOAT

In this episode of The Roots Podcast, hosts Tyler Lingle and Max Moore sit down with Ed Neu and Ryan Cheek of Neu Real Estate Group — the powerhouse duo reshaping Indianapolis through build-to-rent, new-construction duplexes and multi-unit infill development.

Ed and Ryan share how they’ve scaled from concept to 60+ new builds in just two years, what they’ve learned about long-term investing, and how their unique stacked-duplex design is changing how Indy investors think about cash flow, maintenance, and tenant retention.

From 25%-down new builds to house-hacking FHA options and city-backed neighborhood growth, this episode is packed with insights for investors ready to play the long game.

Consider Pressing Subscribe on the Podcast! It’s a simple way to support what we do and get plugged in. It takes 30 seconds…

Upcoming Events in Indy for the Investor-Minded!

Thursday, Oct 23rd — 7:30-9:00am — Coffee & Connect with special guest Jeremy Tallman, co-owner & co-founder of T&H Realty & Property Management. Make new connections over some morning brew! This will be our most discussion & connection friendly event yet… in the MORNING!

December Real Estate Masterclass @ Guggman Haus Brewing — Topic: Finding Deals that Actually Make Sense led by Investor-Friendly Agents. Thursday, December 4th, Find details here!

Thanks for the read!

I started in real estate in mid-2021 after 4 years teaching in inner-city Indy. I found a passion for real estate after house hacking on Indy’s eastside. In 2023, a partner and I started Roots Realty Co.

Roots is a brokerage team part of the @properties brokerage in Indianapolis. We specialize in helping homeowners & investors Plant Roots & Build Wealth. We offer unique insights into Indy / Investing but also one-of-a-kind networking and education events. Come meet us…

Book a time to chat to delve into your goals! Whether you’re a seasoned vet or complete newbie to all of this.

Quick Ask — If you gained value from this newsletter, a share with someone likeminded in your network would be hugely appreciated.